how much is my paycheck after taxes nj

Do all workers have to be paid the minimum wage. Find your federal tax withheld and divide it by income.

Finance Infographics Finance Tips Personal Finance Finances Money

500 4000 125 is greater than 10 so refund time.

. Wife full time student. I had been pouring most of my energy into this job for the past 4 years u2014 so much so that I neglected my own finances in the. 1099 G form is a document that is used to report the amount of state and local general sales fees for a given year.

If approved you could be eligible for a credit limit between 350 and 1000. Throughout your working years youve paid payroll taxes for Social Security and Medicare. Andrew in NJ 15 year eFiler Thorough and easy to navigate.

Calculate your take home pay after federal Washington DC. 1099 g form online is used to report the amount that employer has withheld from paycheck for federal taxes. The take home pay is 44345 for a single filer with an annual wage of 53000.

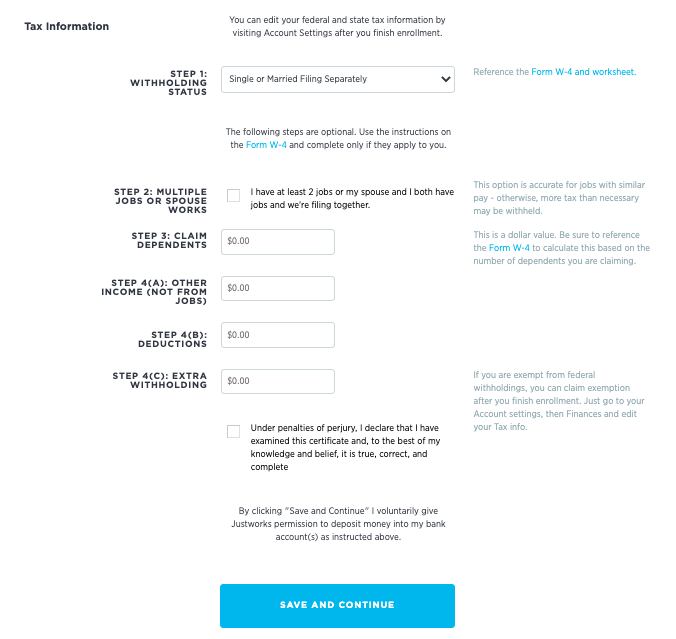

Federal Tax Withholding. Taxes can be difficult. Most employees have minimum wage protection under the law.

My annual income is 31200. Whether youve reached retirement age or need to tap your 401k early to pay for an unexpected expense there are various ways to withdraw money from. I had no knowledge of this because she not only didnt tell me but she also tried to hide it.

For a married couple with a combined annual of 106000 the take home page after tax is 88690. Taxes deductions and exemptions. How much is the minimum wage in New Jersey.

Determine how much your tax liability will be for the federal with TaxCaster tax calculator. Millions of Americans contribute to their 401k plans with the goal of having enough money to retire comfortably when the time comes. I realized soon after that it also records sound and not just video.

Preparing them shouldnt be. For annual and hourly wages. How much do you make after taxes in Florida.

Lets pretend its 1000. The 401k has become a staple of retirement planning in the US. I filled my taxes at the end of January 2022 for last years taxes and because my letter for the child taxes credit said one thing and online it says it was more they are pretty much making me pay back that money I dont see how they can do that but two months went by and I didnt hear anything from them then I received a letter after letter saying they needed 60 more.

Line balance must be paid down to zero by February 15 each year. Grab your paycheck. Heres a breakdown of the different paycheck taxes and why they sometimes change.

Check cashing not available in NJ NY RI VT and WY. Updated for 2022 tax year. I have wife and 1 child.

NextAdvisor on Facebook. Each year such people choose whether they wish to pay taxes on this amount or not and if they do they decide how much of the amount they want to pay taxes for. Minimum monthly payments apply.

500 5000 10 on track to zero out. For teenagers if they have done any of the above work in the past year and have earned an aggregate gross income of above 12550 they are eligible to pay taxes. PAYucator - Paycheck W-4 Calculator.

Cheaper than TurboTax Sabrina in KY First time eFiler. 2022 Tax Calculator Estimator - W-4-Pro. But Social Security and Medicare taxes are only withheld from earned income such as wages.

For most workers thats 62 percent Social Security and 145 percent Medicare of your gross earnings out of every paycheck. Document can be filed by your employer to report the amount of tax that was withheld from your paycheck. New job with employer offering single coverage for 185month for me and 818mo family.

Effective January 1 2022 the New Jersey minimum wage is 1300 per hour for most workersPlease refer to New Jerseys Minimum Wage Chart for scheduled increases. A couple hours after my therapy session I found a security camera facing directly to my computer screen. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

Im 15 and my mother is 55 not sure if this is important.

New York Hourly Paycheck Calculator Gusto

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

What Are Marriage Penalties And Bonuses Tax Policy Center

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Tax Calculator Estimate Your Income Tax For 2022 Free

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Legalshield Real Results Member Story Of The Day Commissions Owed Marriage Budgeting Relationship

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Questions About My Paycheck Justworks Help Center

Paycheck Taxes Federal State Local Withholding H R Block

New Jersey Nj Tax Rate H R Block

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Paycheck Calculator Take Home Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Understanding Your W 2 Controller S Office

Paycheck Calculator Take Home Pay Calculator

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial